The Next-Generation AI-Powered DeFi Infrastructure

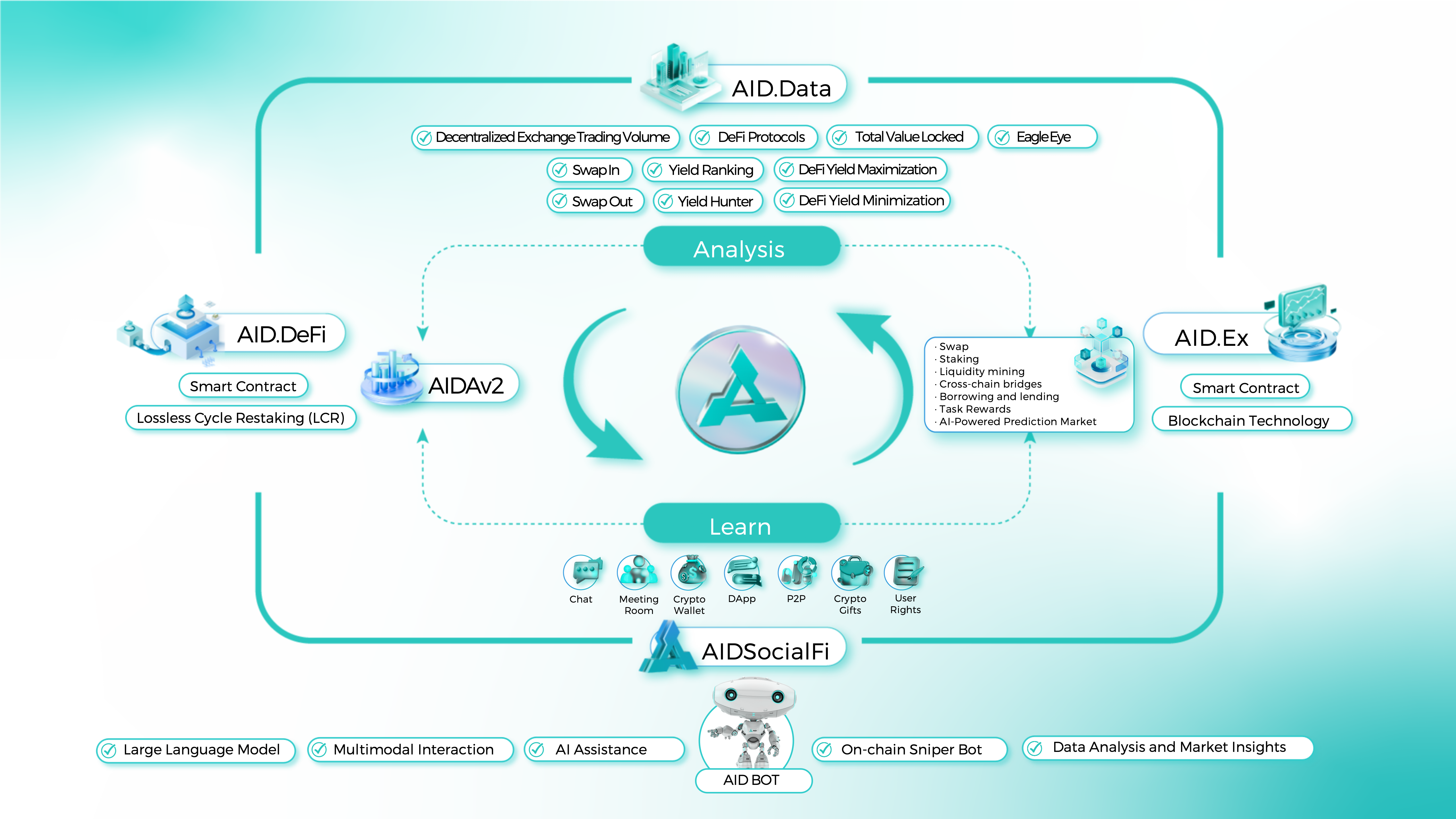

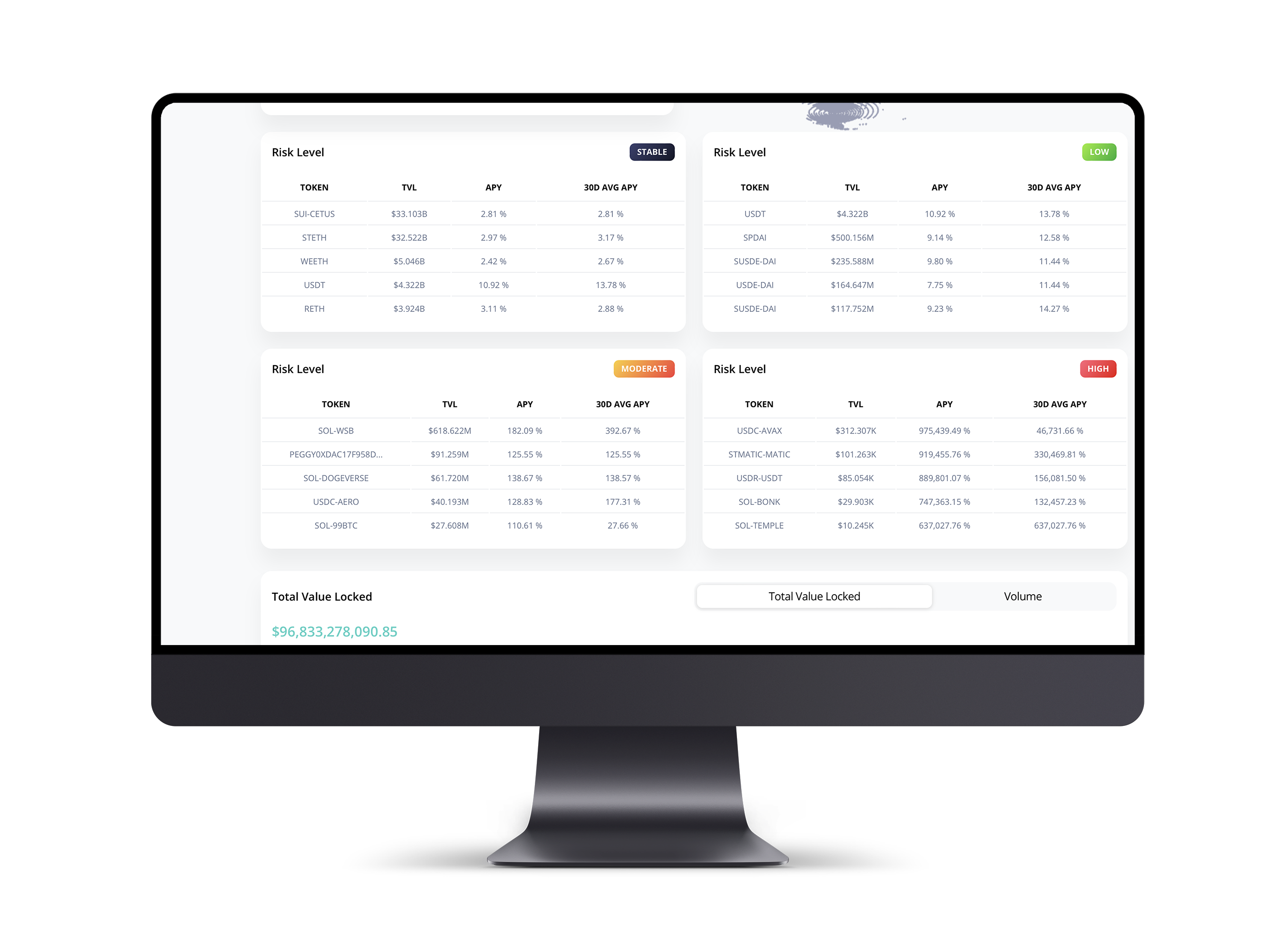

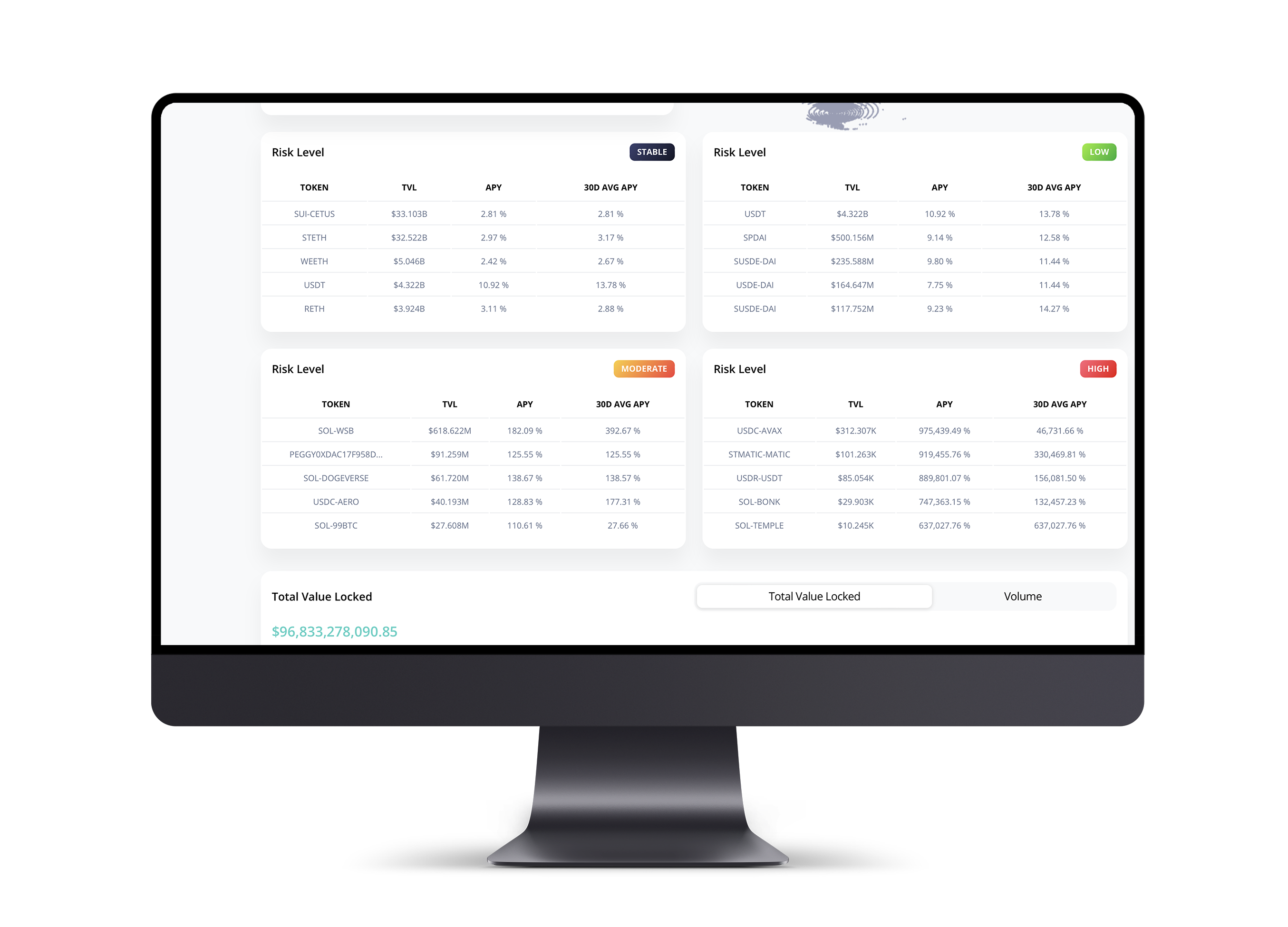

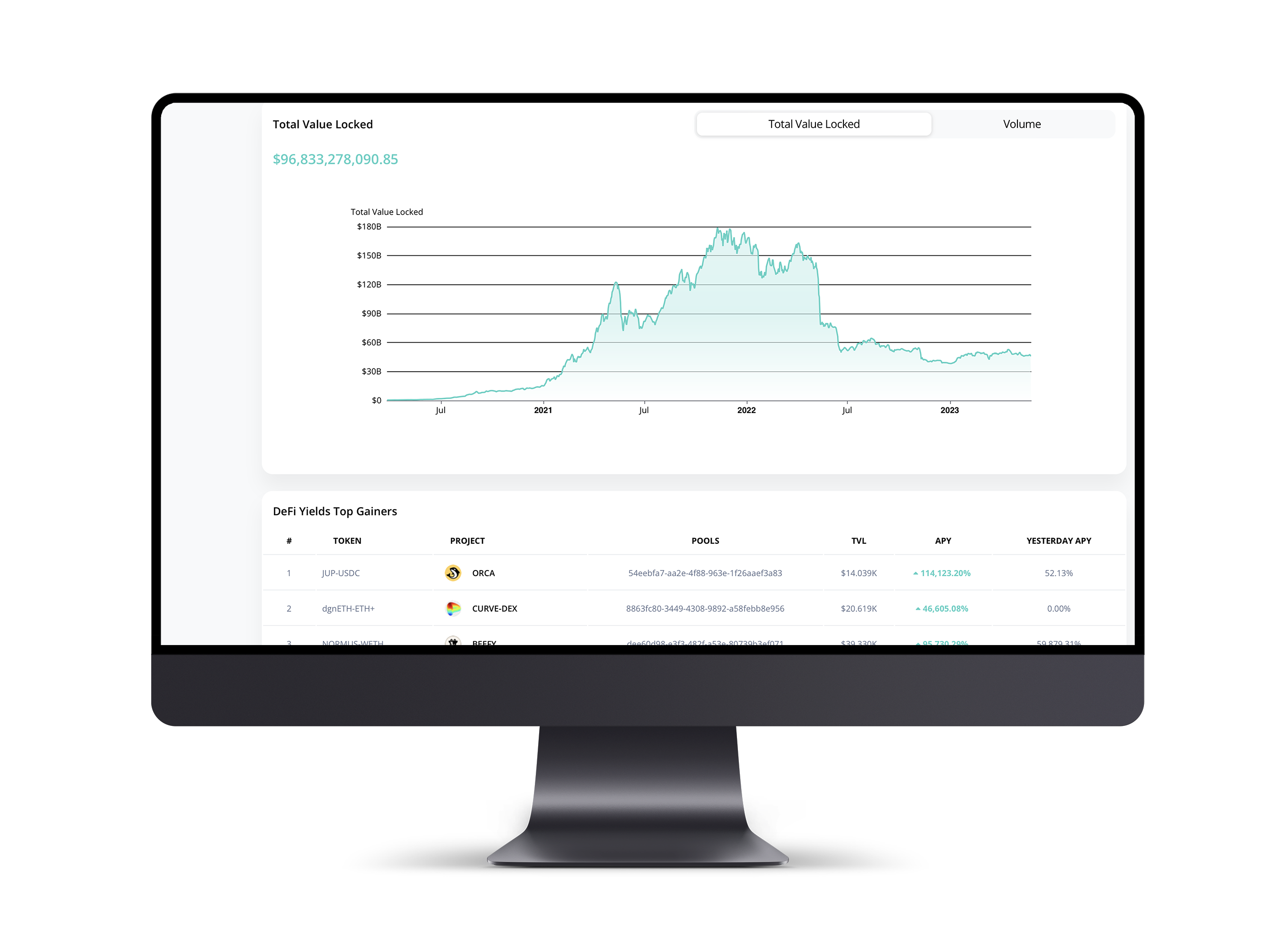

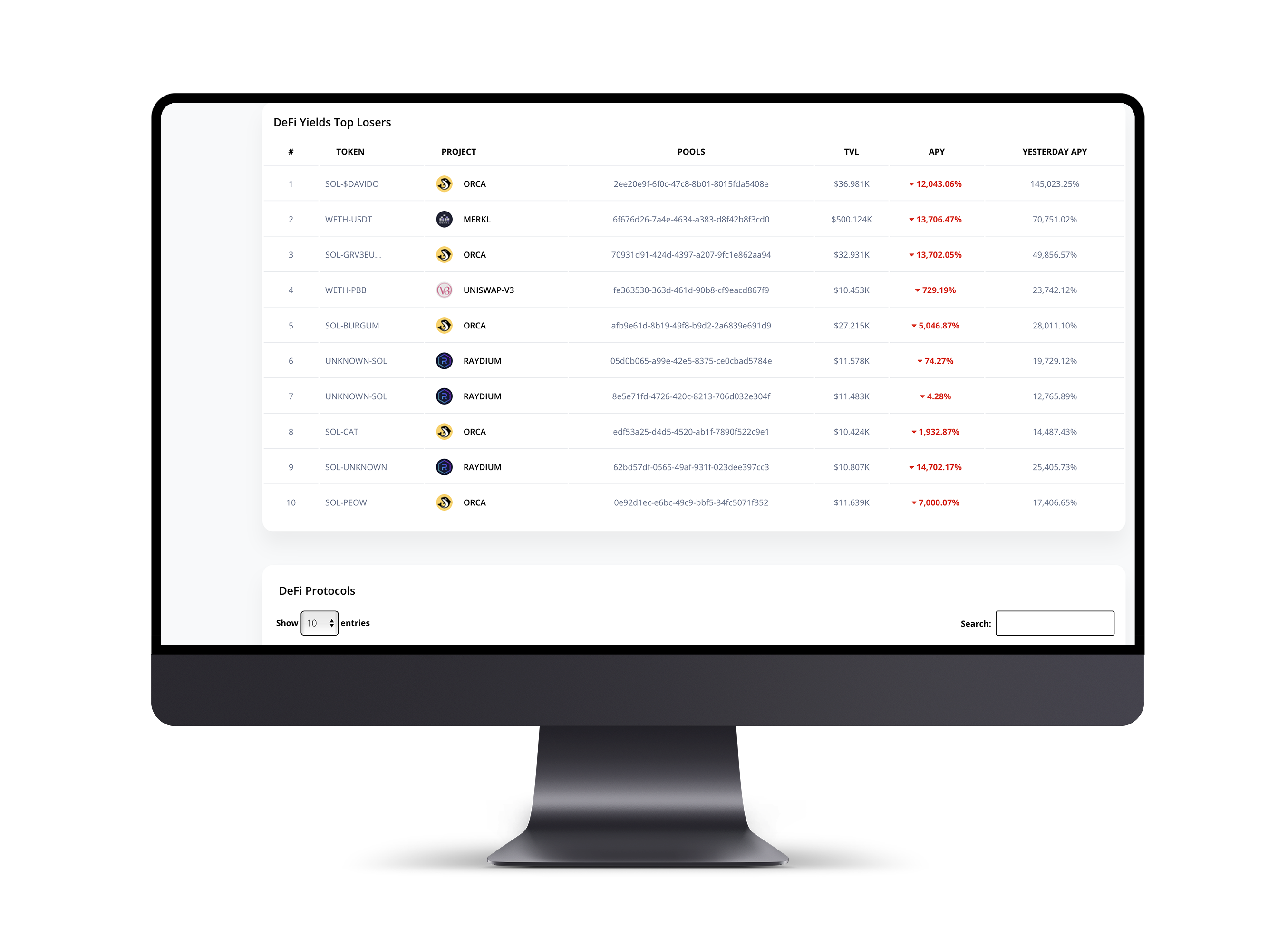

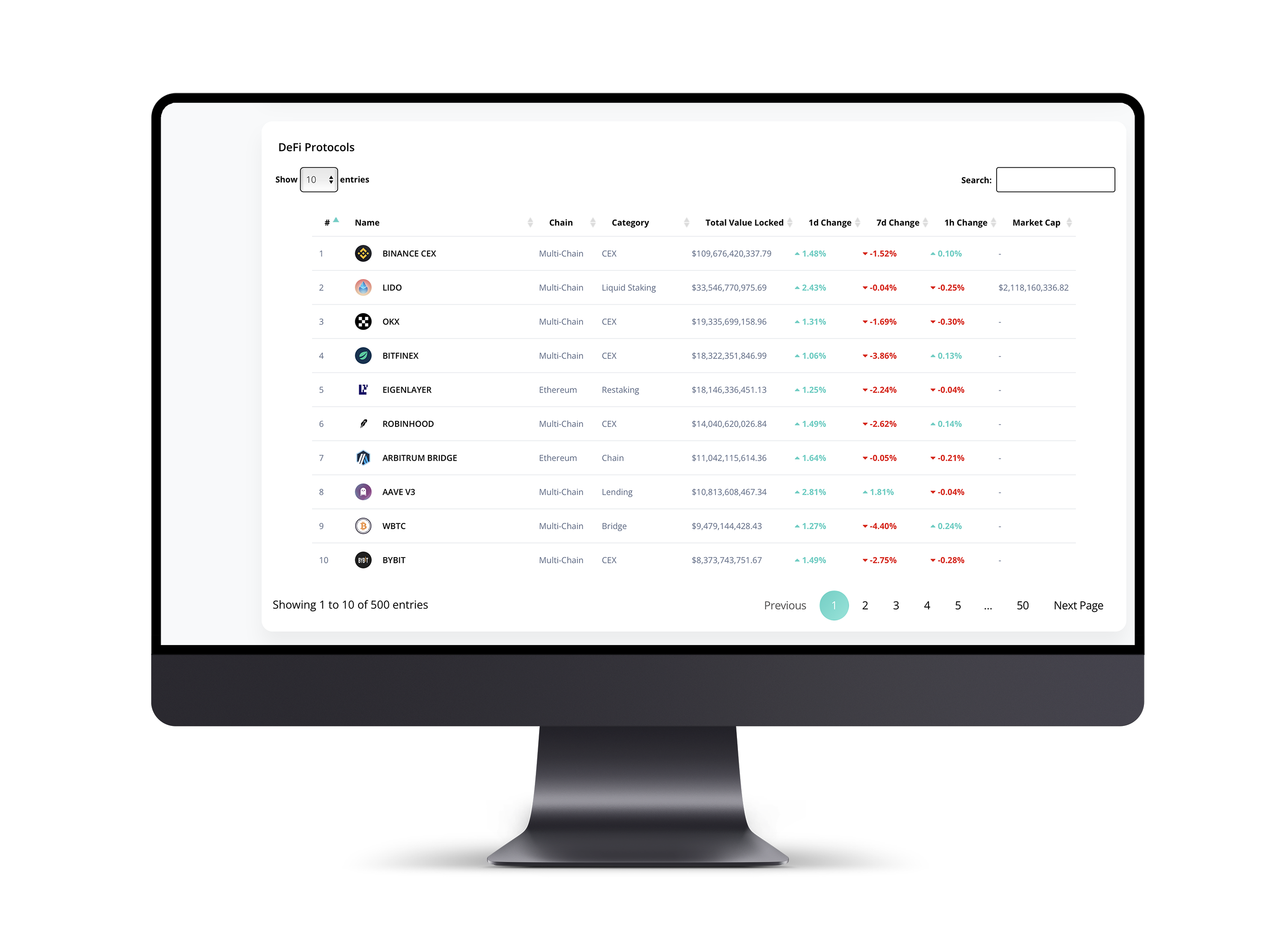

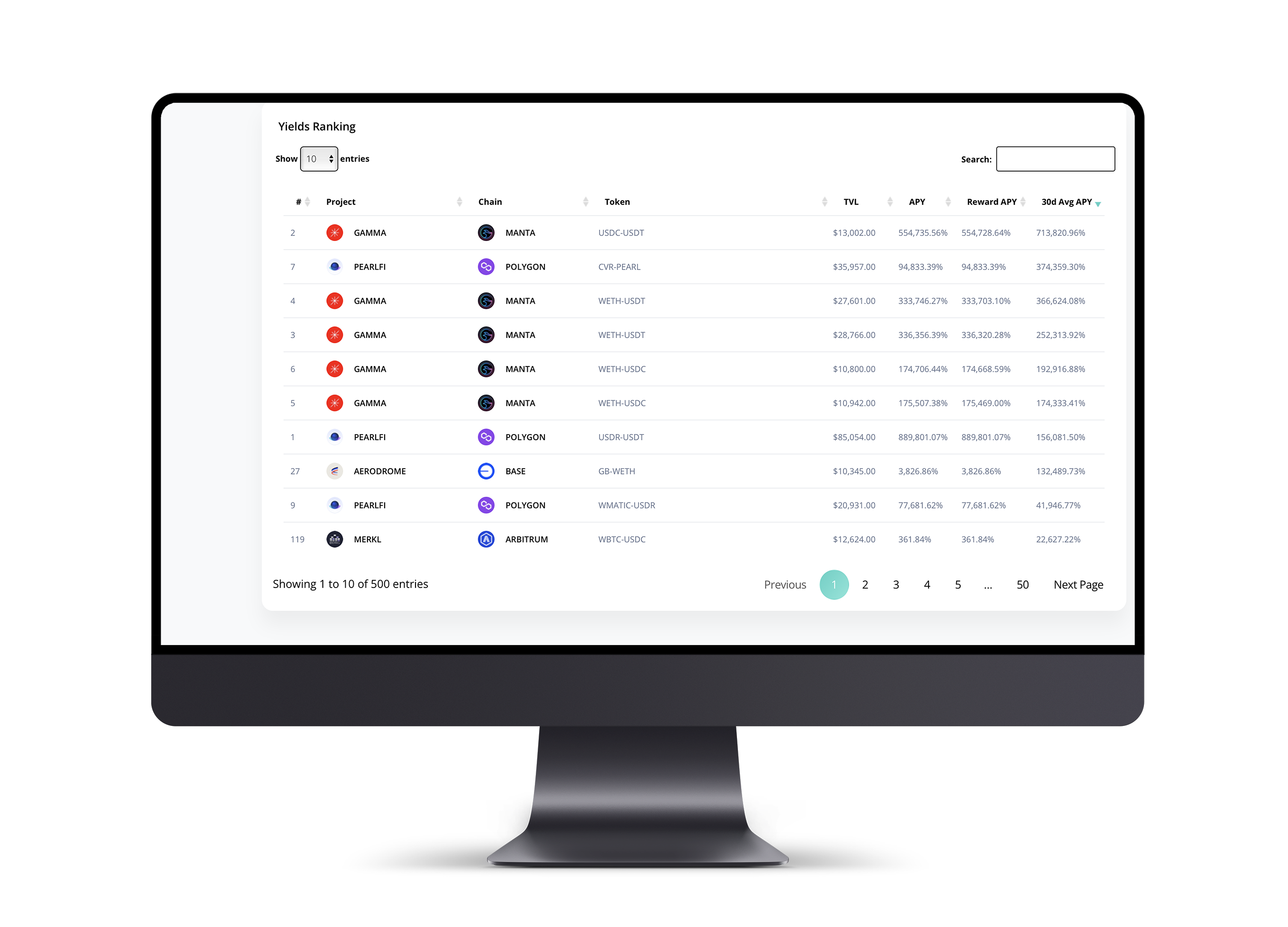

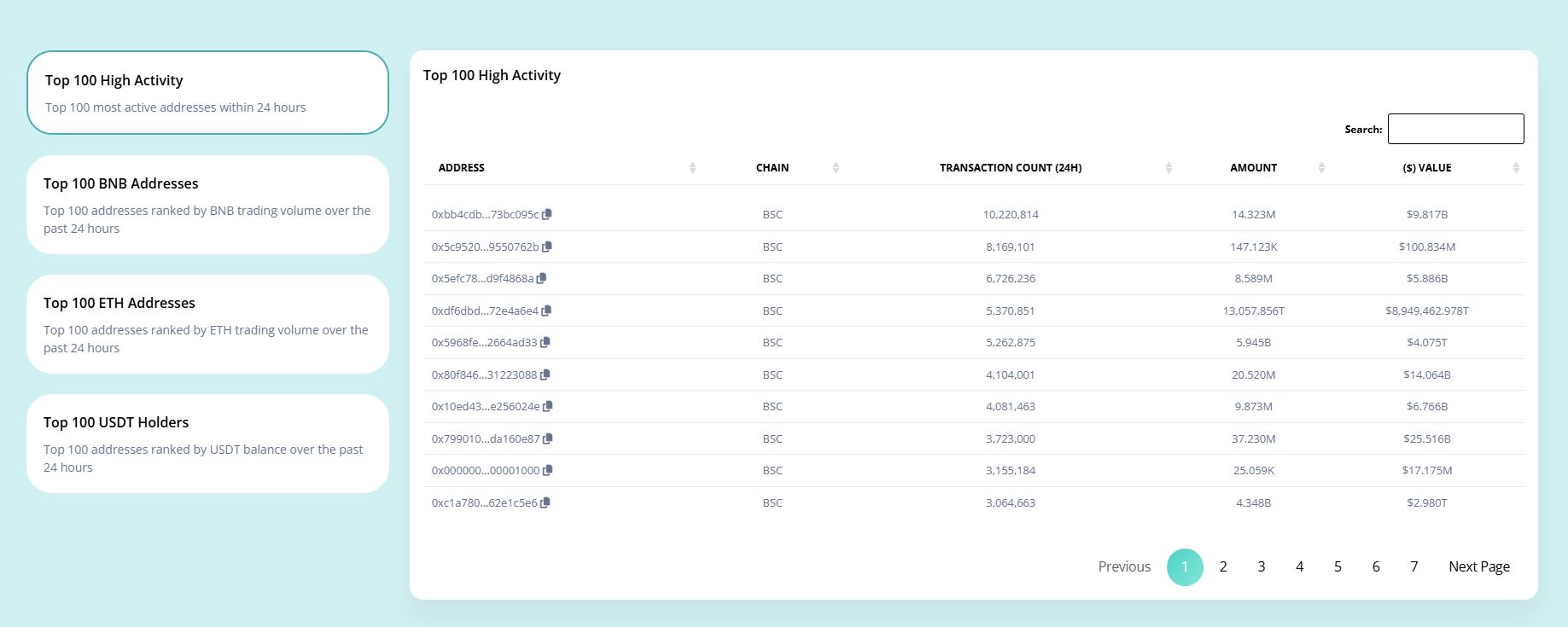

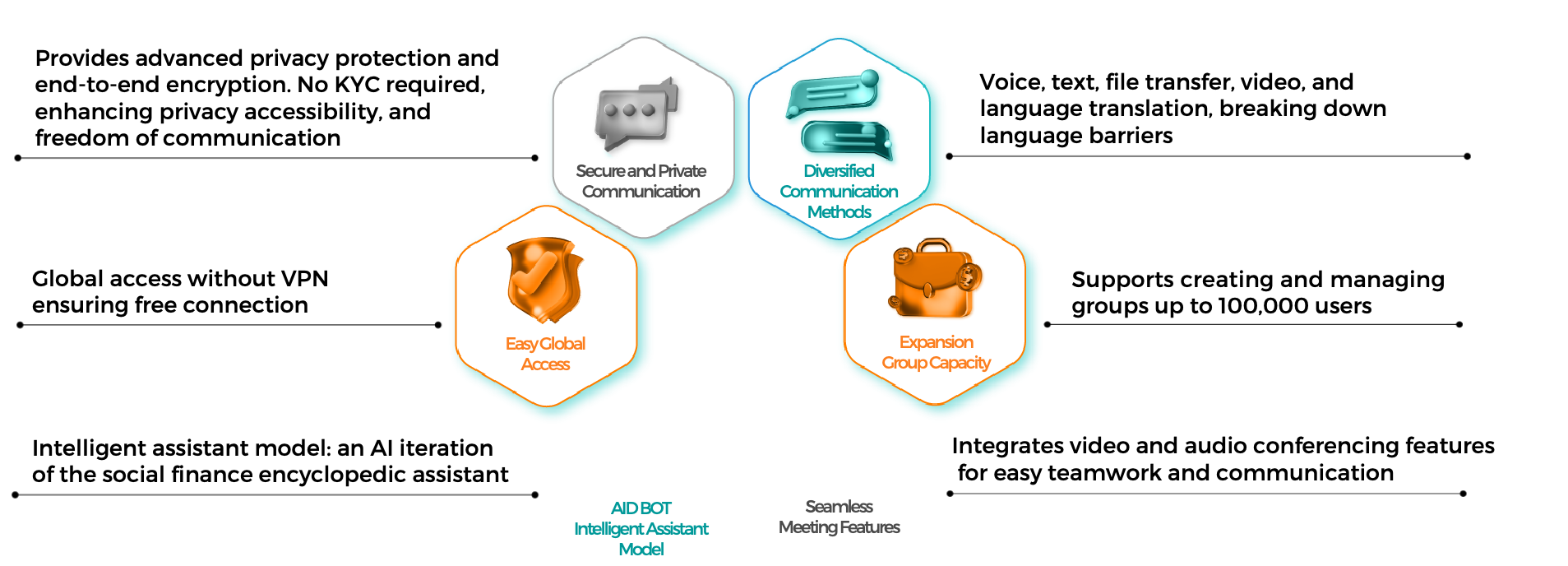

AID is a cutting-edge AI-driven infrastructure designed to redefine decentralized finance (DeFi) by integrating artificial intelligence at every level. Focused on AI development and its application in blockchain ecosystems, AID enhances automation, optimizes decision-making, and revolutionizes data analytics for smarter, more efficient financial interactions. Powering its ecosystem with four intelligent model—AID.Data for advanced analytics, AIDefi (AID) for intelligent DeFi solutions, AIDSocialFi for next-generation AI-driven social finance and AID.Ex for AI-enhanced trading—AID is shaping the future of decentralized AI finance, making Web3 more accessible, efficient, and intelligent.